Is it time for you to trash Modern Portfolio Theory?

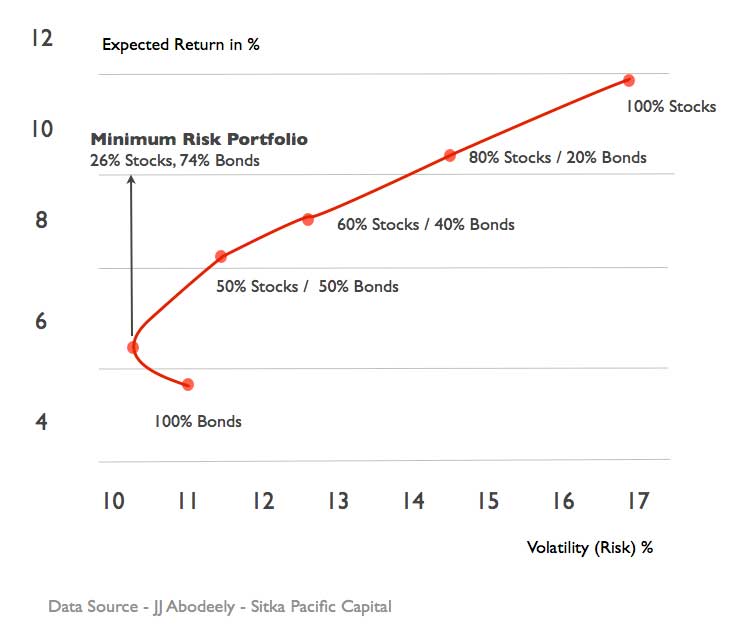

Modern Portfolio Theory (MPT) needs little introduction. Developed by Nobel Prize winning economist Harry Markowitz in 1952, the theory forms the basis of portfolio construction for large swathes of the money management industry. MPT is an approach to how you can optimize returns for a given level of risk. Choosing a selection of assets that form an efficient frontier. See the diagram below.

Despite its popularity the approach has come under attack largely due to the 2008/2009 financial crisis. The hallowed 60/40 stock bond portfolio saw losses close to 15%. While those with an 80/20 mix lost a quarter of their money. The fact is MPT based portfolios performed exactly as intended during the crisis, optimizing returns for a given level of risk (volatility). What the crisis did however is open up a debate about the effectiveness of the theory. This leaves you with a fundamental question. Is it time to trash Modern Portfolio Theory?

Risk Is Not Volatility

In his 2011 paper “Is Portfolio Theory Harming Your Portfolio” Scott Vincent starts with something all money mangers implicitly understand. “Risk is in the eye of the beholder”. MPT defines risk as variance from the mean (volatility). As JJ Abodeely noted in his excellent blog post about the failings of MPT, Harry Markowitz chose volatility because it was “mathematically elegant” and “computationally simple”.

What does this mean for you? It means choosing a portfolio that provides an appropriate amount of risk and return depends heavily on how you define risk. For some clients capital preservation (downside risk) is a lot more important than variance (keeping up with the long run average). If this is the case for your clients then it might be time to trash MPT.

Some of the advisors I speak to would call this a mute point. What matters is a client’s goals then you construct the portfolio to get you there taking an appropriate amount of risk. However, notice how risk still needs to be considered regardless of whether a client’s goals are the first step in portfolio construction.

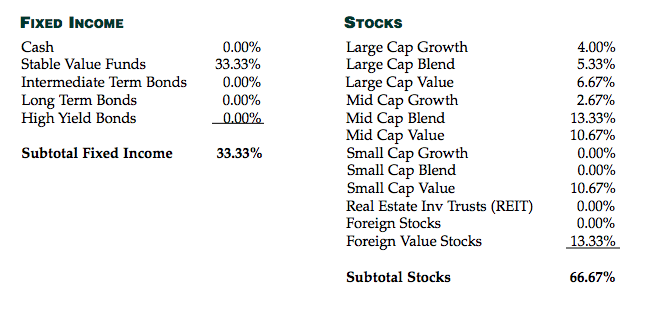

Enter Post-Modern Portfolio Theory (PMPT). PMPT measures risk by looking at the downside. Essentially, how bad are the bad times rather than simply how are the times on average (MPT). The theory can then be used to construct a portfolio that has limited downside yet meets the required goals of your client. The result is often portfolios that look wacky at first (e.g. The Permanent Portfolio) but deliver results. Take a look at the portfolio below for an example proposed by Unified Trust that has a historical return of 11.54% with a downside deviation of 2.2%.

The problem with such a portfolio is that it flies in the face of conventional wisdom. If advisors are to trash MPT and switch to something like PMPT they need to be brave. MPT has Nobel prizes and decades of support. Inertia is on its side. It would take a brave advisor to recommend the portfolio above and stick with it when the markets (and the wider investing community) favor a traditional 60/40 stock bond portfolio. If it’s true that downside risk is your client’s biggest concern and you are targeting a 8-10% average annual return then using PMPT and trashing MPT must be the way to go.

Historical Performance Is No Guarantee Of Future Returns

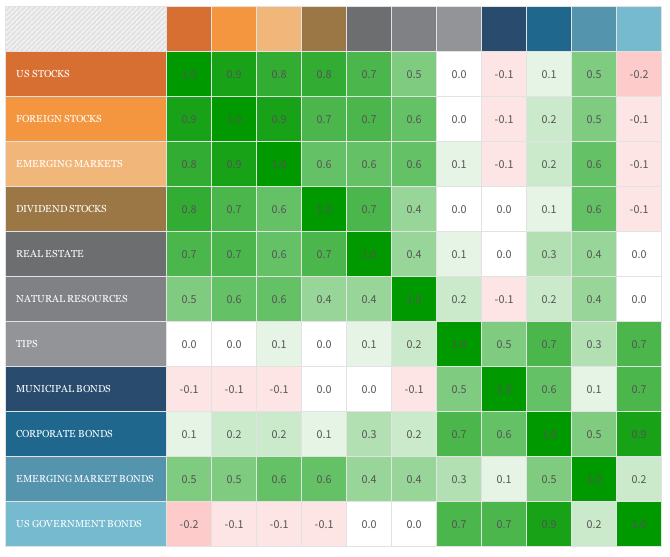

Practically every financial product comes with this boilerplate warning. “Historical performance is no guarantee of future returns”. Yet MPT relies heavily on back testing to justify its position. The cornerstone of this back testing is using the historical correlations between asset classes to choose a diversified portfolio. The table below from Wealthfront outlines the correlations between different asset classes.

The problem with using historical correlations to inform your decision-making is that correlations change. Stocks and bonds may have been uncorrelated yesterday but that doesn’t mean they will be tomorrow. Furthermore, during wars or a general market collapse various asset classes can move in sync canceling out any diversification.

So what does this mean for you as an advisor? It means we cannot simply rely on historical correlations to justify an asset allocation. We have to exercise some judgment. Use historical correlations as one weapon in your arsenal but do not base your entire strategy on it.

What Next After Modern Portfolio Theory?

It’s clear that MPT has some serious flaws. Its definition of risk is questionable and it relies too heavily on back testing to justify its existence. That being said I don’t believe we should embrace market timing either.

Post Modern Portfolio Theory sets us on the right track by having a realistic definition of risk. Taking this definition we can find an asset allocation that minimizes downside risk yet yields a healthy average annual return. We just have to make sure it is a portfolio that minimizes costs, is easy to manage and has reason for its construction beyond historical performance.