Lessons from FPA conference: Increase equities in retirement

I recently returned home from the annual Financial Planning Association conference in Seattle. There were lots of great breakout sessions but the one that got me thinking the most was Michael Kitces’s presentation about the “Rising Equity Glidepath”. If you have a chance to see him speak, please do. He delivers his points intelligently with lots of energy and great humor. Simply put, increasing the amount of equity a client has in retirement will improve outcomes and reduce the chance that they will run out of money.

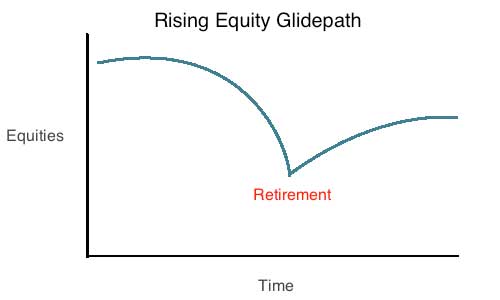

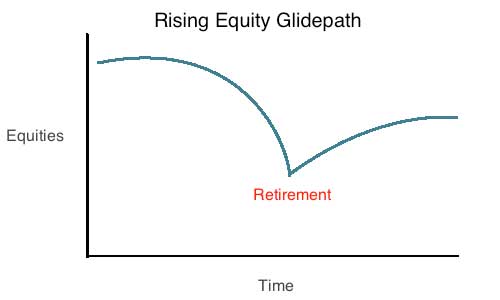

This is because of the threat of sequence risk (retiring as the market collapses). If the first years of retirement happen to be during a downturn then by slowly increasing the equity exposure over time the client will be dollar cost averaging into markets at “cheaper and cheaper valuations” and if markets are good then they have little to worry about. Below is a diagram I put together to illustrate this point.

Obviously, this approach flies in the face of conventional wisdom. Luminaries like Jack Bogle, the founder of Vanguard have long preached you should have your age in bonds.

What Kitces has observed however, is that many advisors are already unwittingly increasing their client’s equity exposure over time by having a bucket strategy. By having a portion of the portfolio in cash for near time spending, another block in bonds for spending in the next 5-7 years and then the rest in equities the exposure to the stock market will increase over time as the cash and/or bond interest is spent.

If we are already “secretly” increasing equities in retirement why not be open about it with clients and optimize for better results? I spoke to one financial advisor at the conference who said they had floated the idea with clients but they were met with consternation. Openly and directly increasing equities in retirement is far too contrarian for most clients. Perhaps the bucket strategy is the only way to get this past client psychology.

During his session Kitces also talked about the impact of market valuations on choosing the right equity glidepath in retirement. Using the Shiller PE Kitces explained that retiring in “overvalued” periods tends to lead to a lower safe withdrawal rate. Unsurprisingly, the best way to recover is to increase equity exposure during the downturn.

Lastly, Kitces said he would be doing research on the best way to reduce equity exposure, as one gets closer to retirement. I’ll be writing about that, as soon as it is published.