Pocket Risk is a reliable and efficient online risk profiling tool in Canada for financial advisors. Its comprehensive features provide a thorough evaluation of clients’ attitudes towards risk, allowing advisors to make informed investment decisions and making risk assessment in Canada easier.

Utilizing statistical analysis is key to ensuring precise risk evaluation. Pocket Risk incorporates this data-driven approach, providing a reliable risk score for clients based on their responses, which makes risk management in Canada dependable. We also stay up to date with current market trends and economic indicators to enhance our risk assessment capabilities, ensuring accuracy in the face of changing conditions.

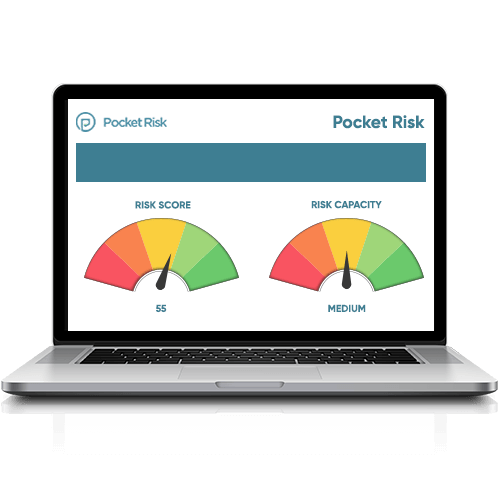

The tool provides a comprehensive risk analysis report that includes a risk score, risk capacity level, and detailed insights into a client’s investing preferences and financial goals. The risk scoring system is based on statistical analysis and is designed to provide accurate results. This system takes into account a client’s responses to the questionnaire and applies an algorithm to produce a customized risk score that ranges from 1 to 100. The results are presented in an easy-to-understand format that allows advisors to discuss and recommend investment strategies that are tailored to their client’s specific needs.

Risk Capacity

Risk Tolerance

Risk Required

When it comes to investing, every client is unique. That’s why Pocket Risk offers tailored questions that are relevant to your client’s investment objectives and risk appetite. This ensures that each questionnaire is customized specifically for them, giving you a better understanding of their individual needs. Our customization options don’t end there. It also allows advisors to create custom questionnaires for certain types of clients, whether they be high-net-worth individuals or first-time investors. And once the questionnaire is complete, we provide customizable reports with detailed insights into each client’s unique financial situation. With this level of customization available at your fingertips, you can confidently guide your clients towards investments that are right for them.

Pocket Risk offers an intuitive user interface that is easy for both advisors and clients to navigate. This ensures a hassle-free experience, even for those with limited technical proficiency. What’s more, it requires minimal time commitment from both parties while still producing accurate results. We understand the importance of seamless integration in today’s fast-paced business environment. That’s why Pocket Risk integrates easily with commonly used CRMs like Salesforce and Redtail. Advisors can efficiently manage their client data on one platform without worrying about compatibility issues or manual data entry errors.

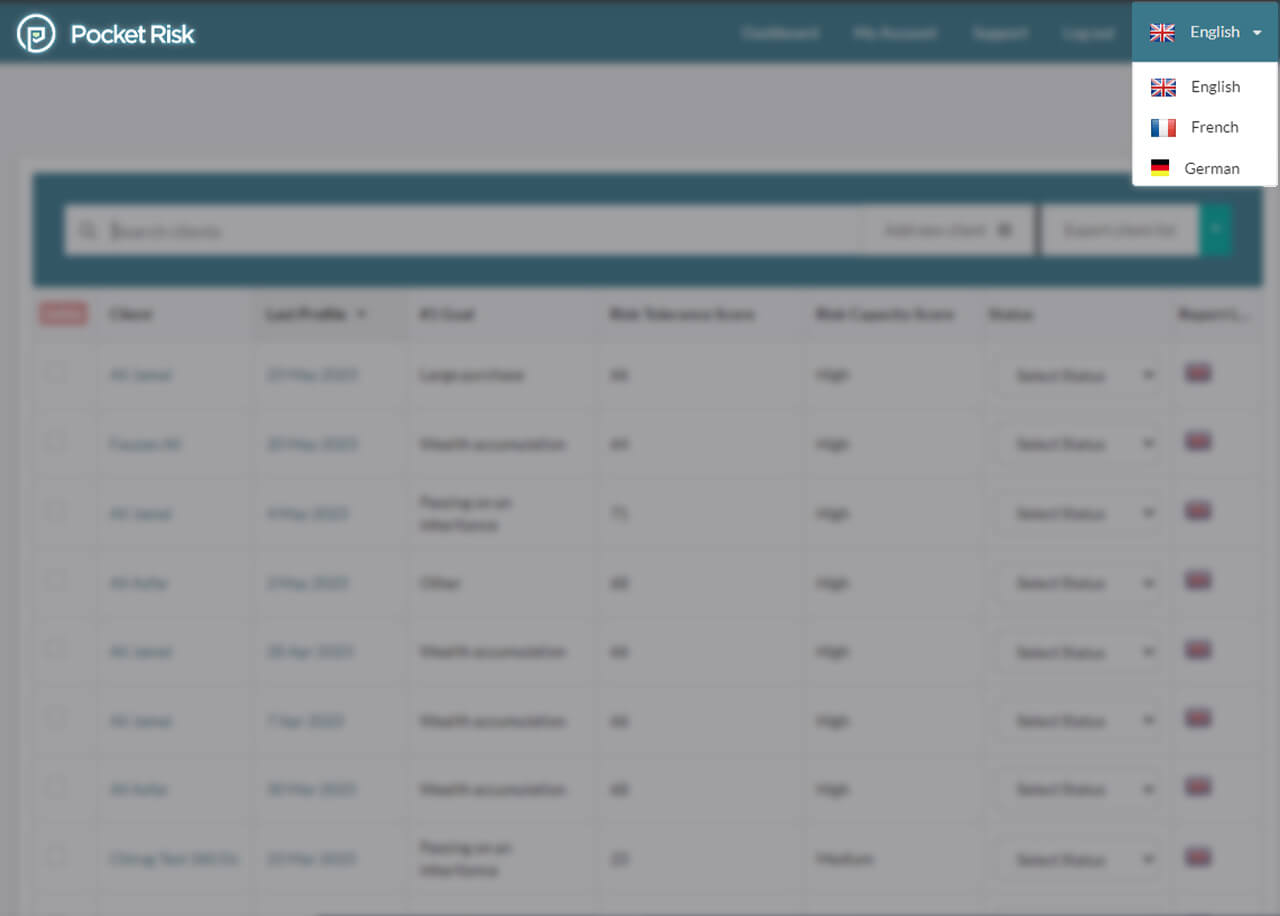

In addition to its many features, Pocket Risk also offers multiple language support. It recognizes the diversity of Canada’s population and the need for advisors to serve clients in their preferred language. Pocket Risk is available in English, French and German making it accessible to advisors and clients who speak either language.

This level of language support is particularly important for advisors who serve clients in Quebec, where French is the official language. With Pocket Risk, advisors can provide a personalized experience to their clients, ensuring that language is not a barrier to providing quality financial advice. Pocket Risk’s commitment to inclusivity also extends to its pricing, with no extra charges for language support.

Pocket Risk has compliance incorporated within its design. Regulatory guidelines are at the forefront of the platform’s development, ensuring that all activities carried out within it are aligned with national privacy laws. The tool also maintains updated data protection policies to comply with evolving privacy laws in Canada. This ensures that all client information remains secure while using the platform. Our questionnaire is compliant with MFDA, IIROC, and other regulatory authorities, which makes it the most trusted choice of Canadian financial advisors. With these features in place, financial advisors can focus on providing quality service without worrying about compliance concerns or potential legal issues down the line.

Our pricing is competitive compared to other providers. We offer solo, professional, and business plans depending on the client’s needs and size. There is a special discount for enterprise users. Payment options available include credit card and bank transfer. Our system is equipped with SSL encryption to ensure secure transactions. We are confident that you will find our risk profiling tool beneficial, which is why we offer a free 14 days trial period so that you can test it out before committing to a full subscription.

Our financial planning software for Canadian financial advisors not only provides accurate risk assessment, but also comes with dedicated account manager assistance. This means you’ll have a go-to person who can guide you through any issues or questions that may arise during the process.

We understand that onboarding can be overwhelming, so our team is here to provide support from start to finish. We offer comprehensive onboarding assistance so that your transition to our platform is seamless and stress-free. In addition, we have a frequently asked questions section on our website which provides quick answers to common queries.

Invite your clients to complete the risk tolerance profile, and compare their risk

tolerance with their investment strategy.